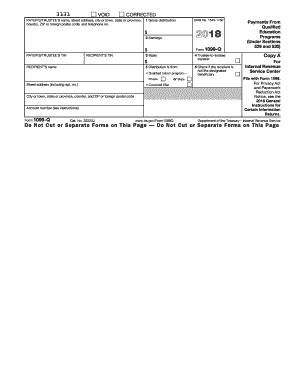

IRS 1099-Q 2019-2025 free printable template

Show details

For the latest information about developments related to Form 1099-Q and its instructions such as legislation enacted after they were published go to www.irs.gov/Form1099Q. Copy C For Payer Certain Information To complete Form 1099-Q use Returns and the 2018 Instructions for Form 1099-Q. To order these instructions and additional forms go Due dates. 1220. Need help If you have questions about reporting on Form 1099-Q call the information reporting customer service site toll free at...

pdfFiller is not affiliated with IRS

Understanding IRS Form 1099-Q: A Complete Guide

Step-by-Step Instructions for Modifying IRS Form 1099-Q

Guidelines for Completing IRS Form 1099-Q

Understanding IRS Form 1099-Q: A Complete Guide

The IRS Form 1099-Q is essential for those using tax-advantaged accounts to pay for education expenses, such as 529 plans. This form helps recipients report distributions received for qualified education expenses. Navigating IRS Form 1099-Q accurately is vital for maintaining compliance and avoiding potential tax issues.

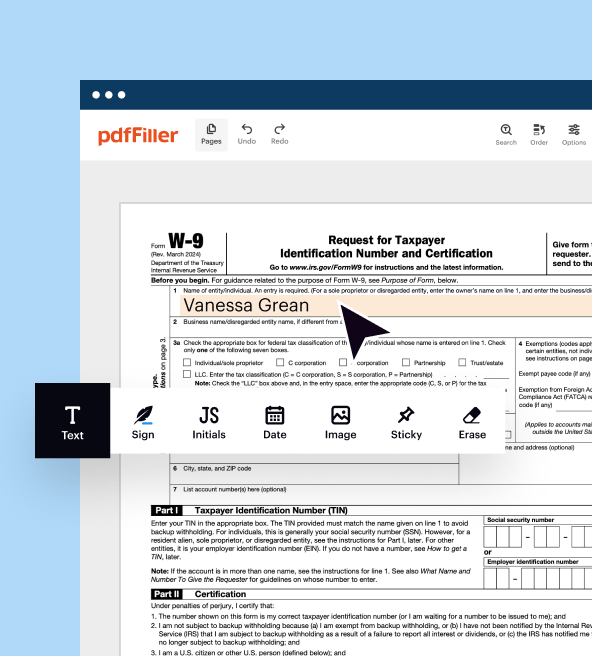

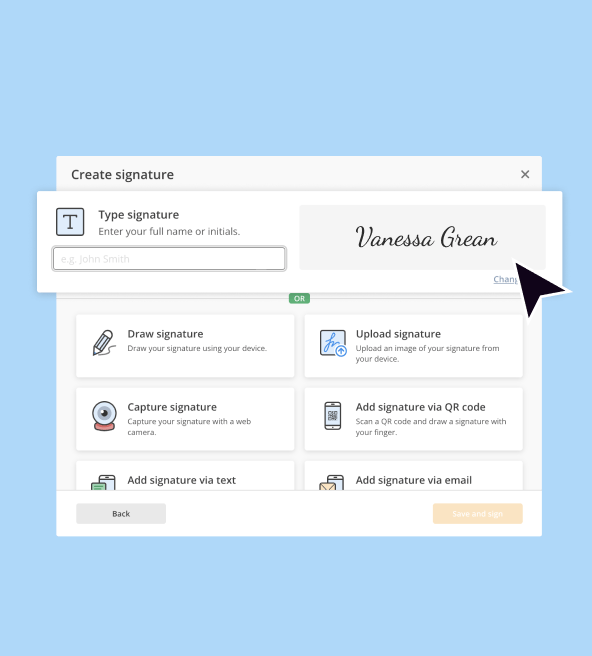

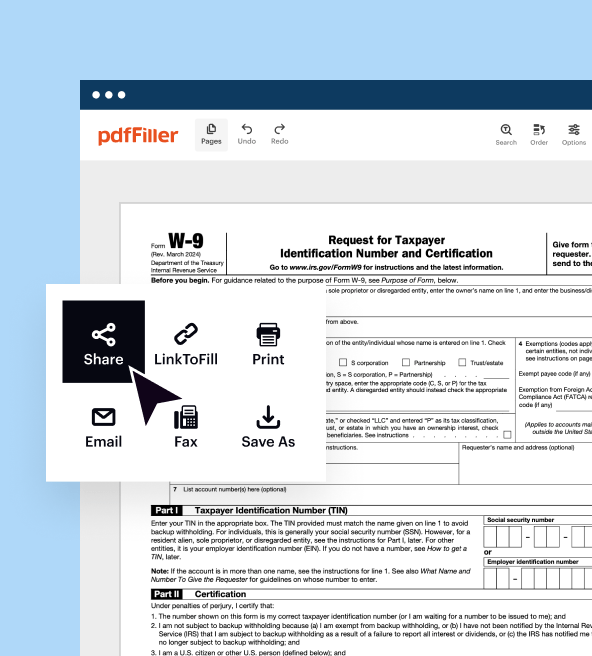

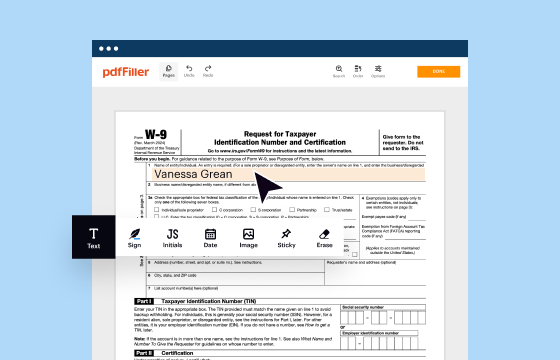

Step-by-Step Instructions for Modifying IRS Form 1099-Q

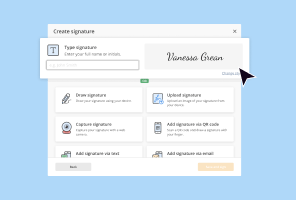

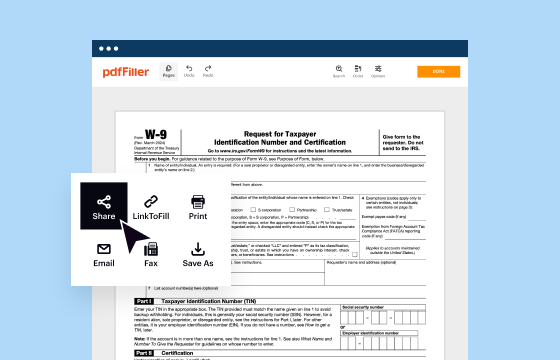

Follow these actionable steps to edit IRS Form 1099-Q accurately:

01

Access the form from the IRS website or your tax filing software.

02

Ensure you have the original information readily available for accurate data entry.

03

Carefully input the recipient's details, including their Social Security Number and address.

04

Record the distribution amounts in the appropriate boxes, ensuring correct categorization.

05

Review the completed form for any errors or omissions.

06

Save or print the form as necessary for your records.

Guidelines for Completing IRS Form 1099-Q

Completing IRS Form 1099-Q requires attention to detail. The form includes specific fields that must be filled out correctly:

01

Box 1: Total gross distributions from the account.

02

Box 2: Earnings on the account that were distributed.

03

Box 3: Basis of the amount distributed, which is typically your contributions.

04

Box 4: The state income tax withheld, if applicable.

Be sure to corroborate each entry with supporting documents such as statements from the financial institution managing the account.

Show more

Show less

Recent Updates to IRS Form 1099-Q

Recent Updates to IRS Form 1099-Q

Staying informed about recent changes to IRS Form 1099-Q is crucial for compliance. The IRS has updated certain thresholds regarding tax-free distribution limits. Make sure to check the latest tax regulations to understand how these changes may impact your filings.

Essential Information About IRS Form 1099-Q

What is IRS Form 1099-Q?

What Purpose Does IRS Form 1099-Q Serve?

Who is Required to File IRS Form 1099-Q?

Under What Conditions is an Exemption Applicable?

Components of IRS Form 1099-Q Explained

Filing Deadline for IRS Form 1099-Q

Comparing IRS Form 1099-Q with Other Tax Forms

Transactions Covered by IRS Form 1099-Q

Number of Copies Required for Submission

Penalties for Failure to Submit IRS Form 1099-Q

Information Needed for Filing IRS Form 1099-Q

Additional Forms Accompanying IRS Form 1099-Q

Where to Submit IRS Form 1099-Q

Essential Information About IRS Form 1099-Q

What is IRS Form 1099-Q?

IRS Form 1099-Q reports distributions from qualified tuition programs (QTPs), including 529 plans and Coverdell Education Savings Accounts. This form is provided by the financial institution managing the account to the IRS and the taxpayer.

What Purpose Does IRS Form 1099-Q Serve?

The primary purpose of IRS Form 1099-Q is to document distributions utilized for education expenses. Recipients must report this information on their tax returns to ensure proper calculation of taxable income and adherence to educational tax benefits.

Who is Required to File IRS Form 1099-Q?

Financial institutions or plan administrators are responsible for completing and filing IRS Form 1099-Q when they distribute funds to a designated beneficiary. Beneficiaries of 529 plans or other education savings accounts will receive this form if they withdraw funds during the year.

Under What Conditions is an Exemption Applicable?

Exemptions to reporting on IRS Form 1099-Q may apply under certain circumstances. Qualifying conditions include:

01

Distributions used solely for qualified education expenses.

02

Income thresholds that fall within specific limits, avoiding reporting for low-income earners.

03

Payments made directly to eligible educational institutions.

For example, if a student withdraws $5,000 for qualified tuition, that distribution may not need to be reported if it meets all criteria.

Components of IRS Form 1099-Q Explained

Understanding the components of IRS Form 1099-Q is integral to proper reporting: Boxes indicate specific types of distribution amounts and whether any taxes should be withheld. Familiarize yourself with the layout to efficiently fill out the form.

Filing Deadline for IRS Form 1099-Q

The deadline for filing IRS Form 1099-Q is typically January 31 of the following tax year. Ensure prompt submission to avoid penalties and maintain compliance with federal tax laws.

Comparing IRS Form 1099-Q with Other Tax Forms

IRS Form 1099-Q differs from similar forms such as IRS Form 1099-SA, which is used for Health Savings Accounts (HSAs). While both report distributions, the uses and tax implications are distinct, requiring recipients to understand the specific circumstances of each form.

Transactions Covered by IRS Form 1099-Q

IRS Form 1099-Q covers transactions involving withdrawals from education savings accounts intended for qualified expenses. It’s crucial to differentiate between qualified and non-qualified distributions, as non-qualified withdrawals can lead to tax liabilities.

Number of Copies Required for Submission

When filing IRS Form 1099-Q, typically, you will need to submit one copy to the IRS and provide a copy to the individual receiving the distributions. If filing with paper forms, be aware of any additional state requirements or copies.

Penalties for Failure to Submit IRS Form 1099-Q

Non-compliance with filing IRS Form 1099-Q can lead to significant penalties. These can vary based on the severity and duration of the violation:

01

$50 to $275 per form if filed late, depending on how late the form is.

02

Potential criminal charges for willfully failing to file or providing false information.

03

Loss of eligibility for tax benefits related to education if the form is not reported accurately.

Compliance not only avoids penalties but ensures proper benefit claims for educational expenses.

Information Needed for Filing IRS Form 1099-Q

To file IRS Form 1099-Q successfully, gather the following details:

01

Recipient’s complete name and Social Security Number.

02

Address of the recipient.

03

Details of the distributions made throughout the tax year.

Having this information readily available streamlines the filing process.

Additional Forms Accompanying IRS Form 1099-Q

In certain cases, you may need to file additional forms alongside IRS Form 1099-Q. One common form is IRS Form 1096, which is a summary form for submitting multiple 1099 forms to the IRS. Be sure to check specific requirements based on your filing scenario.

Where to Submit IRS Form 1099-Q

Submit IRS Form 1099-Q directly to the IRS based on the submission guidelines for your filing method—either electronically or via mail to the designated processing center. Ensure proper attention to detail to avoid any unnecessary delays in processing.

Being thorough with IRS Form 1099-Q ensures compliance and maximizes potential tax benefits for educational expenses. If you are unsure about any step in this process, consider consulting with a tax professional or reaching out to a tax support service for assistance.

Show more

Show less

Try Risk Free