Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

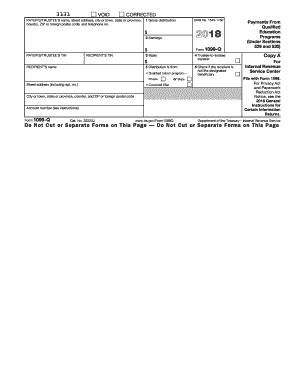

Form 1099-Q is an IRS form used to report qualified tuition program payments to the Internal Revenue Service (IRS). It is used to report payments from Coverdell Education Savings Accounts (ESAs) and Qualified Tuition Programs (QTPs). The form is issued to the recipient, usually the student, and the payer of the QTP funds, usually the student's parents.

Who is required to file 1099 q?

1099-Q is used to report payments from a qualified education program (Coverdell education savings account, or ESA). The payer is typically the financial institution that holds the account, such as a bank or brokerage firm.

What is the purpose of 1099 q?

A 1099-Q is a form used to report income from qualified tuition programs. It is used to report distributions from a Coverdell Education Savings Account (ESA) and certain distributions from a Qualified Tuition Program (QTP). These distributions are reported to the IRS and the recipient of the 1099-Q. The 1099-Q is used to determine the tax implications of the distributions and to report the income to the recipient for taxation purposes.

What information must be reported on 1099 q?

The 1099-Q form provides information regarding distributions from education savings accounts, such as a Coverdell Education Savings Account (CESA) or a Qualified Tuition Program (QTP). It reports the total distribution amount, the taxable amount, the recipient’s name, the recipient’s taxpayer identification number, and the payer’s name and address. The form also reports whether the distribution was used for qualified or non-qualified educational expenses, the date of distribution, and the type of account from which the distribution originated.

When is the deadline to file 1099 q in 2023?

The deadline for filing 1099-Q in 2023 is April 15, 2024.

What is the penalty for the late filing of 1099 q?

The penalty for the late filing of Form 1099-Q is $50 per form, with a maximum penalty of $540,000 for all late filed forms.

To fill out a 1099-Q form, follow these steps:

1. Obtain a blank copy of the 1099-Q form. You can download it from the IRS website or request a physical copy from them.

2. Gather all the necessary information. You will need the following details:

- Payer's name, address, and taxpayer identification number

- Recipient's name, address, and taxpayer identification number

- The amount of distributions paid to the recipient for qualified education expenses

- Any earnings or interest earned on the distributions

3. Fill out the payer information in boxes 1-4. This includes the payer's name, address, and employer identification number (EIN).

4. Enter the recipient's information in boxes 5-8. Include the recipient's name, address, and social security number (SSN).

5. Report the distribution amount in box 1. This should be the total amount of distributions paid to the recipient during the tax year.

6. If there were any earnings or interest earned on the distributions, enter that amount in box 2.

7. In box 3, specify the portion of the distribution that represents earnings or interest on the account.

8. Enter the total amount of qualified education expenses paid with the distribution in box 4.

9. Check the appropriate box in box 6 to indicate if the recipient was a beneficiary or the designated beneficiary.

10. Complete the payer's information in boxes 10-14, including the EIN, contact name, and address.

11. If any state income tax was withheld, enter that amount in box 15.

12. Double-check all the information on the form for accuracy.

13. Submit Copy A of the form to the IRS by the due date, which is usually in late February.

14. Provide Copy B to the recipient of the distributions.

It's best to consult with a tax professional or refer to the instructions provided by the IRS for further guidance on specific details and any additional requirements.

How do I edit 1099 q in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your form 1099 q, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out 1099 q form using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign who reports 1099 q parent or student and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit 1099 q instructions on an Android device?

You can make any changes to PDF files, such as 1099 q example form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.